Offences by officials 119. To update the tax laws and bring the countrys tax laws into line with international standards the Income Tax Ordinance 2001 was promulgated on 13 September 2001.

European Tax Evasion In The Light Of The Pandora Papers Eutax

Short title and commencement 2.

. In this light every individual is subject to tax on income accruing in or derived from Malaysia. Unlike GST tax evasion is possible under the sales and services tax system says Veerinderjeet Singh. As the name implies individual income tax in Malaysia is imposed on earned in Malaysia or received in Malaysia from outside Malaysia.

The Income Tax Ordinance 2001. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or.

That said income earned overseas remitted to Malaysia by a resident or individual is exempted from tax. Tax avoidance is completely legaland extremely wise. Leaving Malaysia without payment of tax 116.

Tax evasion on the other hand is an attempt to reduce your tax liability by deceit. Obstruction of officers 117. In Malaysia the black economy is estimated at around RM300 billion.

Although they sound similar tax avoidance and tax evasion are radically different. Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Norway Norway implemented a tax amnesty program during 20082016 for taxpayers who had undisclosed assets hidden abroad.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Tax avoidance lowers your tax bill by structuring your transactions so that you reap the largest tax benefits. Subscribe to our newsletter and get news delivered to your mailbox.

Breach of confidence 118. Criminal probes would result in charges being filed in court under the Income Tax Act 1967 for tax evasion it said. The Income Tax Ordinance was the first law on Income Tax which was promulgated in Pakistan from 28 June 1979 by the Government of Pakistan.

In 2012 the Spanish Minister of Economy and Competitiveness Cristóbal Montoro announced a tax evasion amnesty for undeclared assets. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. It was introduced during Budget 2019 announcement on 2 November 2018.

Pdf Examining The Moderating Effect Of Tax Knowledge On The Relationship Between Individual Factors And Income Tax Compliance Behaviour In Malaysia

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificial Neural Network Method Analysis

Pdf Examining The Moderating Effect Of Tax Knowledge On The Relationship Between Individual Factors And Income Tax Compliance Behaviour In Malaysia

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

The State Of Tax Justice 2021 Eutax

What Happens When You Get Your Malaysia Income Tax Audited

My Say Plugging Tax Leakages The Edge Markets

What Tax Offences Should You Avoid In Malaysia

Fornebu Line An Extension Of Oslo Metro From Majorstuen To Fornebu In 2020 Oslo Train Service Metro Station

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

Tax Revenue As A Percentage Of Gdp In Malaysia And The Oecd Countries Download Scientific Diagram

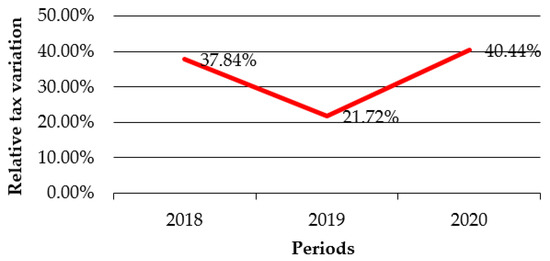

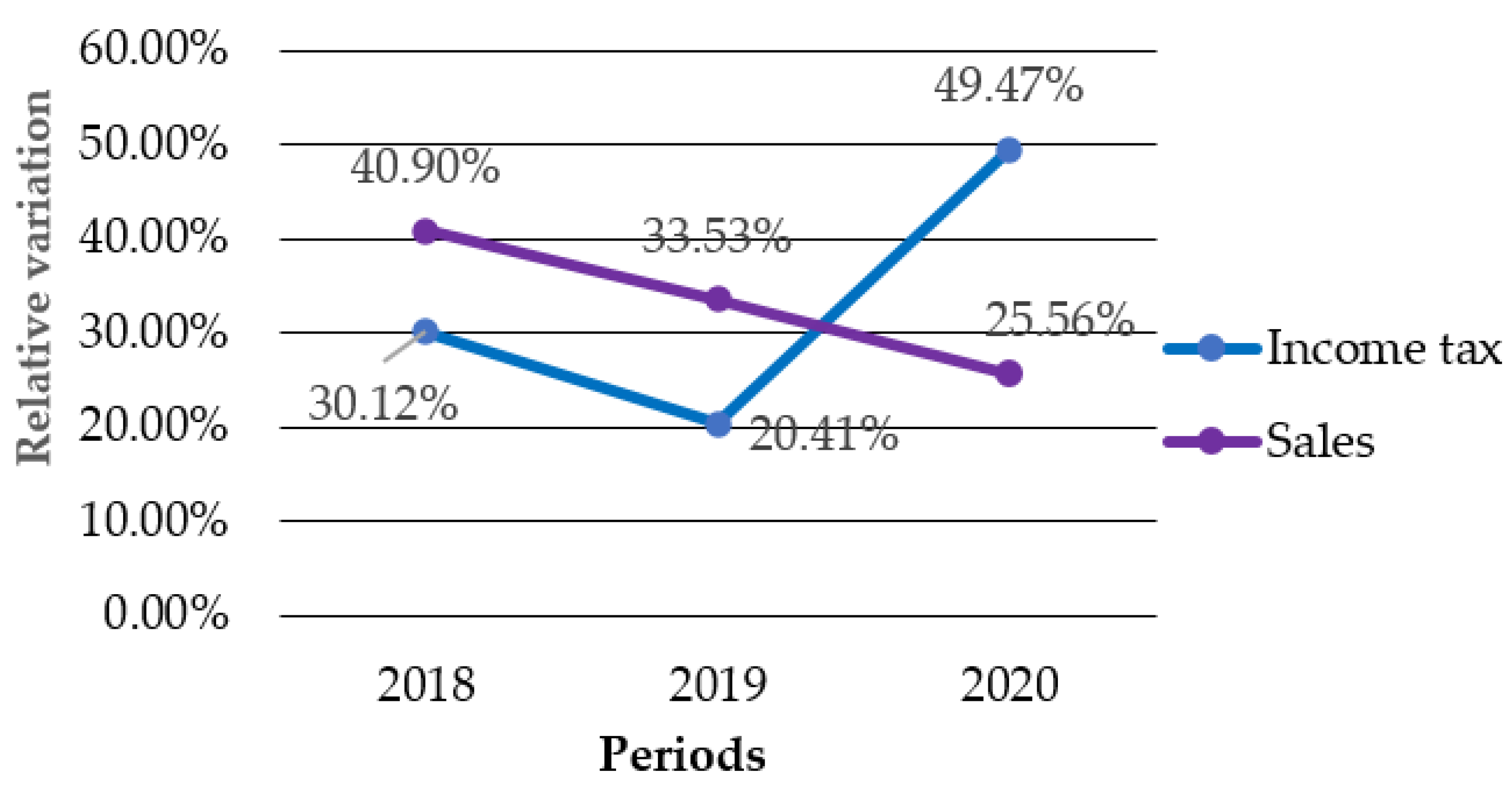

Sustainability Free Full Text Income Tax For Microenterprises In The Covid 19 Pandemic A Case Study On Ecuador Html

Recovering Flight Mh17 Pictures Reuters Malaysia Airlines Places To Visit Investigations

Taxpayers Perceptions On Tax Evasion Behaviour An Empirical Study In Malaysia Semantic Scholar

Pdf Examining The Moderating Effect Of Tax Knowledge On The Relationship Between Individual Factors And Income Tax Compliance Behaviour In Malaysia

Sustainability Free Full Text Income Tax For Microenterprises In The Covid 19 Pandemic A Case Study On Ecuador Html

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International